Graphic Content: SMBs and Mobile Wallets

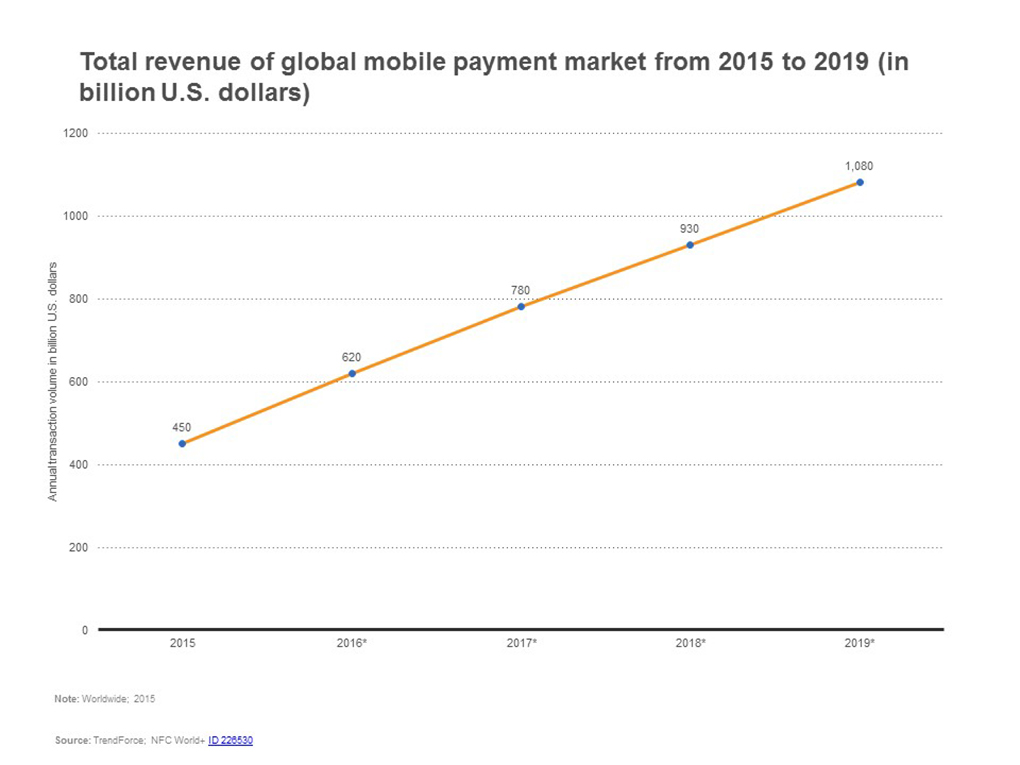

Mobile wallets are one of the new frontiers of electronic transactions. Offering convenience, increased security and greater flexibility, smartphone-based digital wallets from tech companies like Apple Google as well as financial firms like Mastercard and PayPal have steadily gained traction among consumers and merchants alike since their inception a few years ago. Total global revenue for the mobile payments is projected to grow steadily and significantly over the next three years. It is expected to exceed $1 trillion by 2019, and in the U.S., grow 62 percent annually through 2021.

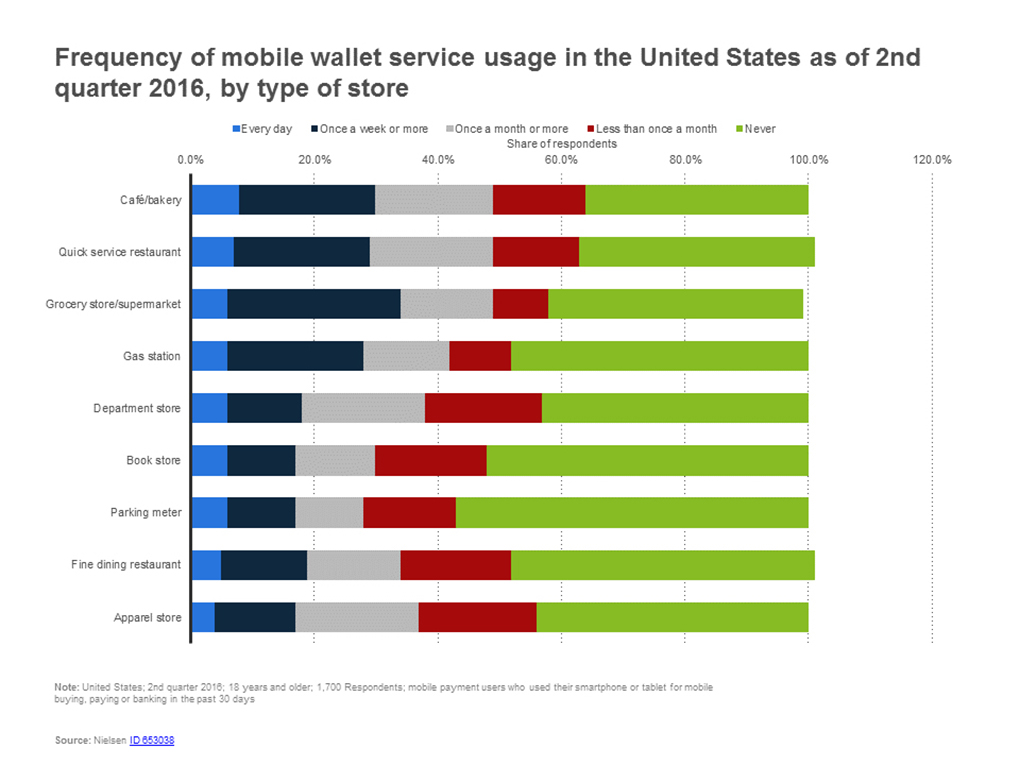

So, there is money to be made for merchants that offer a growing base of consumers fast and secure mobile payments capabilities. Retailers of all sizes are getting onboard, with well over half indicating that they either accept or plan to accept mobile wallets like Apple Pay and PayPal within 1-3 years.

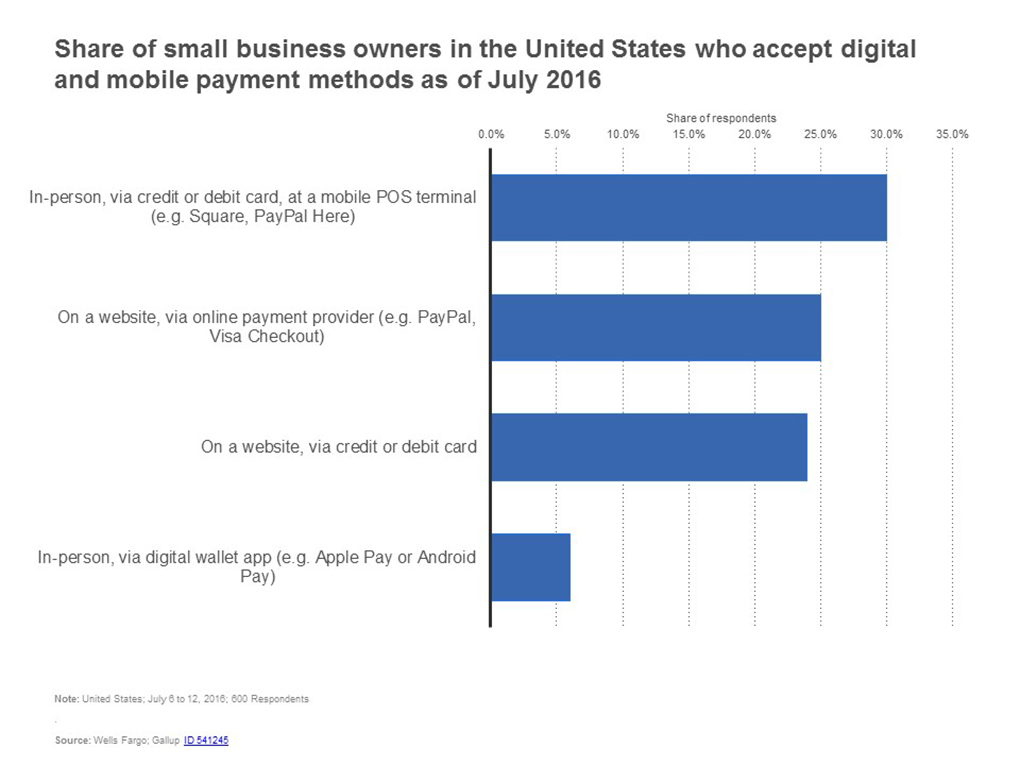

But how are American SMBs faring in the growing adoption of mobile? According to data from Wells Fargo and Gallup, Inc., there is room to grow. Among small business owners in the US who accept digital and mobile payments, most do so through in-person transactions on a mobile POS. Just over five percent indicated that they do so through a digital wallet like Apple Pay.

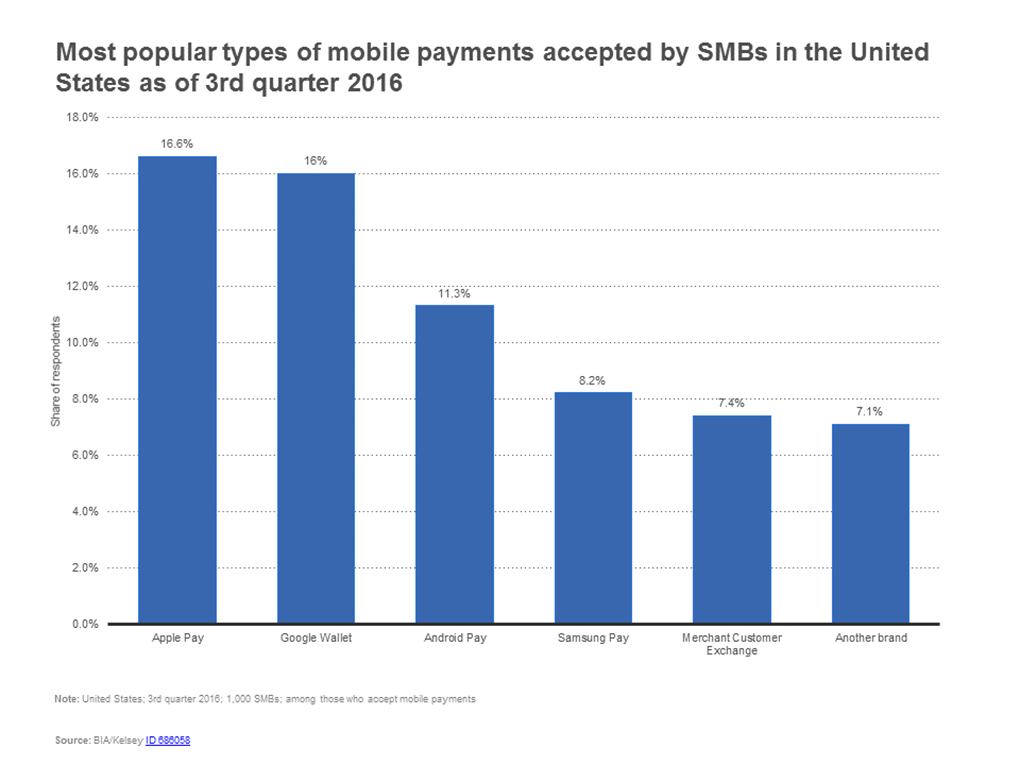

And among SMBs in the U.S., mobile wallets from technology legacy firms have so far been the widest adopted. A BIA/Kelsey study conducted this year found that 16.6 percent of U.S. SMBs accepted Apple Pay, closely followed by 16 percent accepting Google Wallet. Other brands commanded 7.1 percent of the share of respondents, where notable tech wallets Android Pay and Samsung Pay had 11.3 percent and 8.2 percent respectively.