Guest Post: New Channels Pose Challenges, Offer Opportunities to Payments Companies Willing to Partner

By Rick Lang, Chief Engagement Officer, SingleSource.

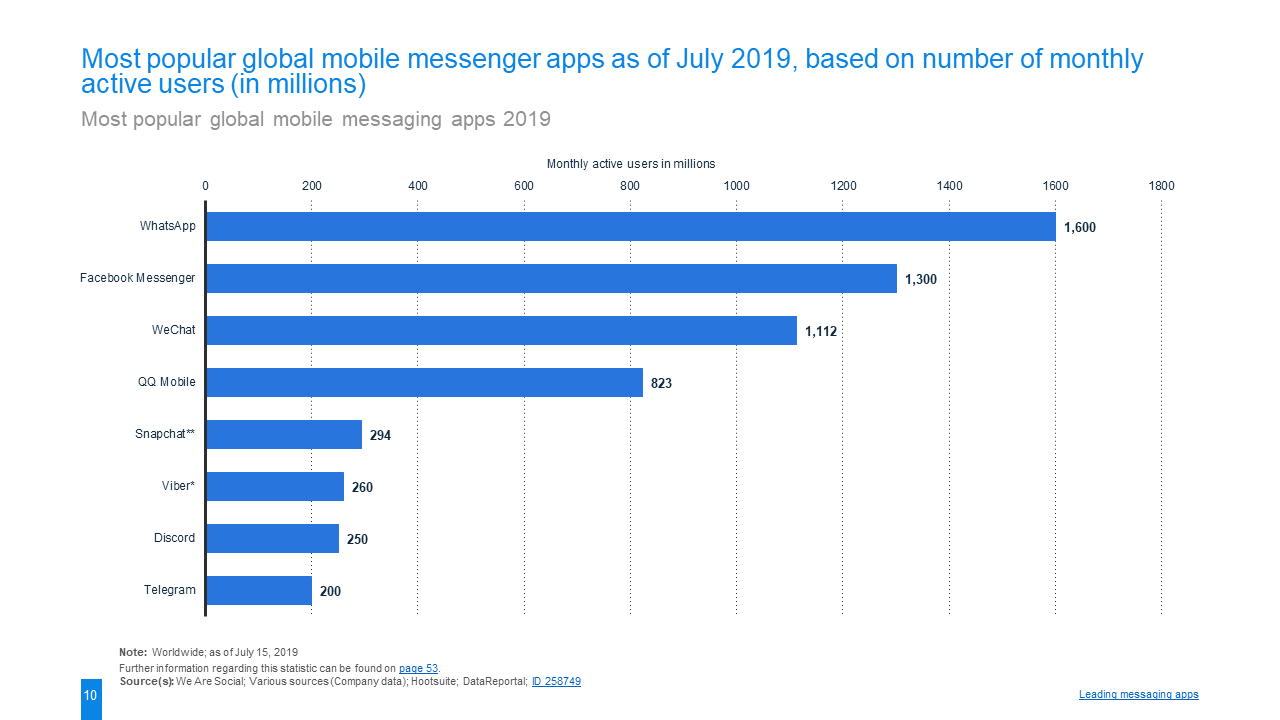

The way that our society shops, communicates, and interacts with each other has dramatically changed. According to a study from Pew Research, 8 out of 10 Americans are now shopping online instead of interacting with retailers. Of those U.S. consumers, 79% shopped from their phones, 51% bought something from their phone and 15% purchased after clicking through on a link shared on social media. However, the Economist states a quarter of all downloaded apps are abandoned after a single use with only instant messaging bucking the trend. Facebook Messenger has 1.3 billion monthly active users globally, and studies have shown that teenagers now spend more time on messaging apps than they do on actual social networks. So, when this group enters the work force or matures as consumers, we will need to determine how to connect with them on their terms.

As a Unified Communications company, this is the type of data that forces our company to constantly evolve, innovate, and adapt. The way that consumers want and choose to interact with a business could be like a spinning a roulette wheel. Will it be a phone call, text message, email, or chat? Nobody knows, so let’s spin the wheel and hope we can connect with the consumer. So, in order to connect with consumers, we must offer the channels they choose to use.

This communication challenge compounds with consumers’ need for instant gratification. Paymill has found that 65% of global customers are not willing to wait more than three seconds for a website to load. Shawn Silver, with Payment Cloud, confirms this same point in his June 2019 member article stating, “Walmart improved conversion by 2% every second that the page loaded faster.” So not only do we, as service providers, have to have multiple communication channels available, we have to respond immediately or we will lose our chance to connect with the consumer.

Gaining new market share is a difficult task by itself. Providing a higher level of service and support is another challenge that is never quite met. As a software company, we are always striving to deliver more while trying to exceed our customer’s expectations. By working together and forming great partnerships, we can share in the workload, deliver a better customer experience, and increase customer longevity.

The Fall Issue of Transaction Trends states, “It’s becoming ever more important for payments companies to provide solutions that simplify the transaction for consumers while adding value for merchants. Partnering with independent software vendors (ISVs) is one way that payments companies are accomplishing those goals.” While this is true, I also believe that having strategic partnerships is vital to the success of any organization.

As a UCaaS (Unified Communications as a Service) provider, one of our goals for joining the ETA is to partner with other services providers to create solutions that would strengthen their product offering as well as our own. The consumer uses multiple technologies from multiples sources to interact with merchants, so let’s do the same. Let’s utilize the technology and resources available within the ETA to create strategic partnerships that answer the needs of consumers quickly no matter which path they choose.