GUEST ANALYSIS: Mobile point-of-sale systems are not all created equal

Derek Webster, Founder and CEO at CardFlight and ETA Mobile Payments Council Chair

With over 1.5 billion smartphones and 200 million tablets being sold per year, the explosion of mobile devices has revolutionized numerous industries that serve businesses and consumers. The payments industry is no exception, and 451 Research projects that the number of mobile point of sale solutions deployed will grow 4x from 2015 to 2019, reaching 54 million units in 2019. Merchants are demanding mobile point of sale (mPOS) technology, leading merchant acquirers and financial institutions to add mPOS solutions to their product lines. As we’ll discuss below, a “one size fits all” approach to mPOS won’t work across all the merchant segments that utilize mobile POS solutions.

What is ‘mobile point of sale’? A quick Google search will return the following result: “An mPOS (mobile point of sale) is a smartphone, tablet or dedicated wireless device that performs the functions of a cash register or electronic point of sale terminal (Point-of-sale terminal)”. But this really doesn’t tell you much.

While hundreds of different mPOS products exist in the market, most solutions are addressed at one of two use cases. The first, which we’ve dubbed “countertop mPOS” is usually an iPad or Android tablet, or other hardware bundle, offered to a business as an alternative to an electronic cash register or purpose-built POS system. Countertop mPOS solutions may be running on a “mobile” operating system like iOS or Android, but they are typically installed at a single point of sale or used within the four walls of a business. The other category, which we’ve dubbed “true mPOS” involves leveraging a smartphone or tablet that can be used by the employee/business to take payments, rather than requiring a new/separate payment acceptance device. True mPOS solutions can be used in the field, for example by a plumber to take payment in their customer’s home at time of service.

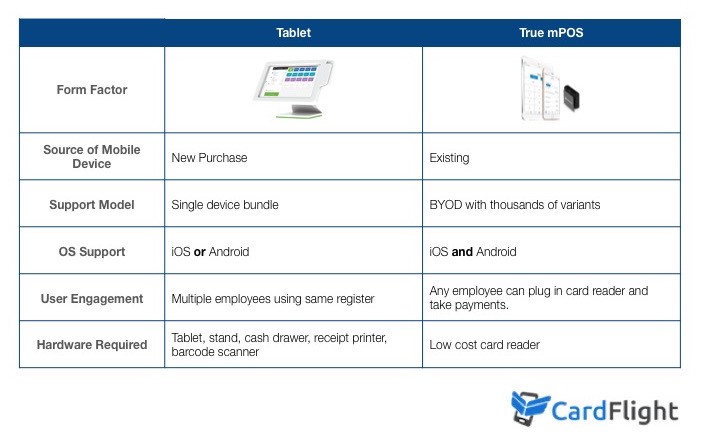

The chart below summarizes the key differences in these solutions and how they’re deployed:

The main difference in hardware and support for countertop mPOS vs. true mPOS is that a true mPOS requires only a smartphone or tablet, which might already be owned by the business, together with a low cost card reader provided by the merchant acquirer. Because any given merchant may utilize an iOS or Android device, it’s imperative that the solution offered supports both operating systems. For a countertop mPOS you receive a hardware bundle that includes a tablet and peripherals which is provided to the merchant at time of sign-up. Because all of the components are being supplied, a solution provider only needs to support either iOS or Android operating systems. The upfront hardware investment is very different across these two solutions and merchant segments.

A countertop mobile POS is usually used by independent retailers and boutiques, quick service restaurants and coffee shops, offering multiple employees access to use one single device that is installed at the checkout counter. While, a true mobile POS is used by in-home services, such as plumbers, landscapers, HVAC repair and more. Other type of merchants who use true mobile POS are special events organizers/hosts, parking lots, seasonal merchants, independent hair stylists, and catering departments of hospitality businesses.

Given the explosive growth of mobile devices, merchant acquirers and financial institutions are wise to find a way to offer mobile payment acceptance solutions to their merchants. But, different merchants have different needs, which is why it’s essential that payment service providers who want to serve the broadest set of merchants offer a solution for both countertop mobile POS and true mobile POS. Given that most suppliers focus on one type or the other, smart merchant acquirers will select and offer a best-in-class solution from each type.