ETA Expert Insights: Mobile Payments – Current Trends and Future Implications

Authored by members of the ETA Mobile Payments Committee

Shalief Arnold, Sr. Manager, Product Management, Digital Strategy, Discover Financial Services • Kevin Dolhay, SVP of Strategic Programing, Payroc • Jennifer Martinez, Executive Director, Solution Management, NCR • Julie Malikayil, Technical Product Manager, Mobile Payments, Discover Financial Services • Craig Ross, Wallet, Payments, and Commerce – Channel Partnerships, Apple • Krithika Thyagarajan, Alternative Payments and Product Enablement Manager, Square • Faye Wilson, Manager, Major Accounts Project and Relationship Management, Electronic Payment Exchange

Introduction

The impact of mobile payments on consumer behavior is increasingly significant across various sectors, including dining, entertainment, gaming, and retail. As digital transactions become more prevalent, it is essential to examine their influence and implications.

Digital payments provide robust security measures against fraud, particularly through advanced identity verification and authentication protocols. The integration of biometric security features, such as facial recognition for transaction authorization, has become a standard that enhances both safety and convenience.

Research commissioned by Discover Global Network indicates that 49% of consumers now feel more comfortable making digital payments than before the pandemic1.

This paper analyzes the role of mobile payments in key consumer activities, such as dining out, entertainment, gaming, and back-to-school, offering a comprehensive overview of current trends and future implications.

Mobile Payments Defined

Mobile payments are defined as regulated transactions executed through mobile devices, typically involving a mobile wallet—an application that stores payment information and facilitates digital transactions via smartphones or other mobile devices2.

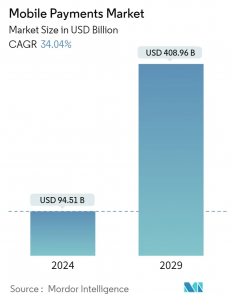

https://www.linkedin.com/pulse/state-mobile-payments-market-2024-data-driven-report-phxif/

The mobile payment landscape includes several methods:

- Card-present transactions at point-of-sale terminals where customers use their phones or smartwatches to pay

- Person-to-person (P2P) transfers through apps such as PayPal or Apple Cash

- Payments via mobile wallets that generate QR codes or barcodes

These methods cater to various use cases, reflecting the diverse applications of mobile payments. Thanks to the ease and accessibility of smartphones, the global QR code payment market is projected to grow by 59%3 between 2023 and 2028, driven by the increasing adoption of mobile technology.

For more information reference the December 2023 ETA article “ETA Expert Insights: SoftPOS/Tap to Pay” and the December 2023 ETA article “QR Codes in Payments”

Dining Out: The Mobile Payment Revolution

The quality of the payment experience has become integral to overall customer satisfaction in the dining sector. Mobile payment technology enhances dining experiences by offering faster and more secure transactions. Younger consumers, who have grown up in a digital-first environment, prefer mobile payments, while older generations are increasingly adopting these methods.

Key insights include:

- 68% of restaurant-goers prefer to pay via contactless or mobile methods, reflecting a broader shift towards digital-first interactions where convenience and security are paramount4.

- 66% of consumers favor mobile wallets for food payments, particularly among Millennials and Gen Z5.

Restaurants adopting mobile payment solutions can benefit from enhanced customer experiences, increased brand loyalty, and improved operational efficiencies. Since 2023, over two-thirds of restaurants have integrated mobile payments into their systems6. Coffee shops and small restaurants are leading the charge by adopting mobile payment technology, allowing consumers to order ahead and have their food ready.

Despite these advantages, some restaurants remain hesitant due to uncertainties about the return on investment. As of 2023, only 42% of restaurants plan to invest in contactless solutions in 2024, and just 38% have fully integrated their POS systems across in-store and digital platforms7.

When implemented correctly, mobile payments can directly impact a restaurant’s bottom line by increasing revenue and reducing costs. Notably, offering digital payment options tends to increase foot traffic, especially when customers can pay from their phones without waiting for the bill or a card reader. These fast transactions lead to higher table turnover, allowing restaurants to seat more customers and reduce the likelihood of walk-outs8.

Events and Entertainment

The increasing use of mobile payments at events and entertainment venues underscores their value in enhancing consumer experiences. The 2021 State of the Union: Global Digital Payments and Fintech Ecosystem report by S&P Global Market Intelligence and Discover Global Network highlights that 46% of US consumers predominantly use mobile devices for online purchases9. Mobile payments streamline transactions, offer personalized experiences, and protect financial data. Recent developments include:

- Alaska Airlines: First airline to offer in-flight Tap to Pay on iPhone for passengers purchasing snacks or beverages.

- Hertz Car Rental: Expanding mobile payment options in partnership with Stripe to enable US customers to use Apple Pay with the Hertz app and website along with other payments experience enhancements.

According to a recent report published by TSG in partnership with Discover Global Network, merchants can best satisfy travel consumers by focusing on solutions that provide simplified, streamlined payment acceptance with robust fraud protection10. The increasing volume of mobile payments at sporting events is a testament to their recognized value. Mobile wallets and dedicated apps are transforming transactions and fan engagement:

- At Fiserv Arena, home of the NBA’s Milwaukee Bucks, orders initiated through mobile devices accounted for 8-10% of order volume per game11.

- The Baltimore Orioles promote their mobile payment method, O’s Pay, accessible in the MLB Ballpark app for exclusive rewards and experiences.

- Chicago Cubs fans can manage digital tickets, access concourse maps, and order food and drinks for delivery to their seats via the MLB Ballpark app.

Government and private parks are also adopting mobile payment solutions:

- Rocky Mountain National Park in Colorado accepts mobile payments at park entrances and campgrounds.

- The Recreation.gov mobile app allows users to search for campsites and purchase tickets directly from their phones.

- SeaWorld Orlando and El Paso Water Parks have transitioned to cashless and mobile options.

- Six Flags launched their first two Quick 6 stores with Amazon’s Just Walk Out technology.

- Visitors to Disney parks can add park passes and payment cards directly to their mobile phones for purchases, rides, and more.

These conveniences enhance consumer experiences, making visits to large venues more enjoyable.

Gaming

The video game industry has experienced rapid innovation, evolving far beyond its early days of slow-to-refresh and pixelated screens. Mobile games continue to break barriers, connecting diverse audiences both in the US and across the globe. As in-app purchases and advertising drive profitable growth, payment flexibility has become essential for game developers.

Industry Trends

- Summer Game Fest: A popular event for developers to showcase upcoming releases and create expectations among avid gamers.

- Cross-platform and cloud gaming: The rise of these services has blurred lines between gaming ecosystems, demanding interoperable payment solutions for a consistent experience across all devices12.

- Apple Pay integration: Apple included Apple Pay as a native feature when they launched their Vision Pro spatial computing headset.

Payment Preferences

The gaming industry is adapting to customer demands and payment trends:

- Digital wallets: Apple Pay and Google Pay are now mainstream due to enhanced security, fast processing, and flexible withdrawal features13.

- Localization: Payment options are being tailored to accommodate regional user preferences, enhancing accessibility for players worldwide14.

- Gen Z influence: This demographic plays a pivotal role in shaping future trends, with 87% playing video games on devices such as smartphones, gaming consoles, or computers at least weekly15.

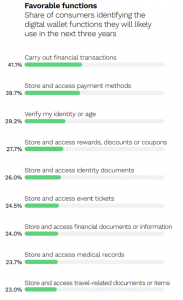

- Mobile-first approach: According to a 2024 study by PYMNTS in collaboration with Google Wallet, 11% of Gen Z consumers never carry physical wallets, preferring digital wallets for transactions16.

https://www.pymnts.com/study/digital-wallets-beyond-financial-transactions/

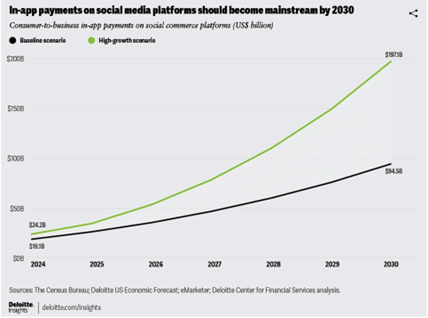

Social Commerce and Gaming

As social commerce grows in value, gaming developers must be prepared to serve a diverse community with seamless integration of secure payment methods. By addressing security challenges and building trust, ‘Gaming-as-a-Service’ has the potential to become mainstream entertainment, provided mobile payments are embedded for players to make purchases.

Technological Advancements

The gaming experience is being transformed by:

- Virtual Reality (VR) and Augmented Reality (AR): These technologies are changing how games are played and experienced18.

- Multiplayer focus: Gaming is evolving from an individual to a social experience, necessitating flexible payment solutions.

- Seasonal promotions: Major players like PlayStation release new versions and provide special offers to loyal customers, creating more value through point systems that extend beyond gaming to cable and internet bills.

As the gaming industry continues to evolve, mobile payments will play an increasingly crucial role in facilitating transactions, enhancing user experiences, and driving the growth of this dynamic sector.

https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-predictions/2024/in-app-payments-next-big-thing-in-social-commerce-trends.html

Back to School

As the summer period transitions to back-to-school preparations, mobile payments facilitate a seamless shopping experience. Families increasingly rely on mobile solutions for purchasing supplies and managing education-related expenses.

Shopping Trends

Mobile payments offer shoppers an omnichannel experience, often combining in-store traffic with online participation. According to the Capital One Shopping Research report from July 202419:

- 65% of online back-to-school consumers shop from a smartphone

- 35% use social media to find products and sales

Retailers are finding ways to combine these technologies to enable targeted sales traffic and extend the in-store experience to online. For example, purchasing goods online and picking up the items in the store. Per the 2023 Deloitte back-to-school survey20, “Consumers want to interact, and the smart retailers will respond with tailored marketing and their own mobile applications that extend the retail experience to the consumer regardless of location, proactively engage the customer, and insulate them from competitors.”

“Consumers expect mobile sites that offer capabilities including ordering, product research, loyalty programs, and more, including mobile payment. Technology such as embedded QR codes, payments with digital wallets, SMS, and location services all support the omnichannel strategy.”

Education Technology

In addition to mobile payments in the shopping experience, many schools are building mobile-focused solutions for students and families that simplify communications and provide easy access to common resources, including enabling mobile payment options for routine education expenses. These mobile solutions allow schools to enable convenient payment services such as:

- Buying tickets to games

- Adding money to school lunch accounts

- Purchasing yearbooks

Solutions such as Apptegy and Clever are bringing mobile payments technology to schools. According to Bryj, a provider of mobile applications, K-12 schools face several challenges such as lack of centralized information, tools and clear communication platforms21.

Mobile apps enable schools to close these gaps while also providing value-added services to reduce manual functions and improve the overall experience for teachers, parents, and students. These school apps also now include QR Code technology to enable payments for routine purchases such as yearbooks and meals22. Clever is one such solution that is bringing the omnichannel experience to education.

From back-to-school shopping to supporting families, students, and teachers all year long, mobile payment technologies are embedded in the consumer experience.

Conclusion

As we progress through the year, mobile payments continue to play a critical role in various aspects of consumer life. From dining and entertainment to gaming and back-to-school shopping, mobile payments provide convenience, security, and efficiency. The widespread adoption of mobile payment technologies underscores their significance in enhancing consumer experiences across different contexts. Mobile payments will remain a vital component of modern transactions, offering seamless and secure solutions for consumers and businesses alike.

Footnotes

2 https://squareup.com/us/en/the-bottom-line/selling-anywhere/mobile-payments

3 https://www.checkout.com/blog/a-quick-guide-to-qr-code-payments

4 https://www.pymnts.com/tracker_posts/why-more-restaurants-need-to-bite-into-digital-transformation/

7 https://www.pymnts.com/tracker_posts/why-more-restaurants-need-to-bite-into-digital-transformation/

8 https://citycheersmedia.com/mobile-payments-make-restaurants-money/

10 https://webview.tsgpayments.com/hubfs/TSG_Discover_Travel_Trends_2024.pdf

11 https://www.carat.fiserv.com/en-emea/resources/Digitising-Stadium-Payments

13 https://www.aeropay.com/blog/explained-what-are-the-best-gaming-payment-options

15 https://www.thedrum.com/open-mic/how-gen-z-is-reshaping-the-gaming-industry

17 Tanuj Parikh on Cash App partnership with Google Play

19 https://capitaloneshopping.com/research/back-to-school-shopping-statistics/

21 https://www.bryj.ai/why-schools-need-to-unify-their-digital-experiences-with-a-branded-mobile-app/

22 https://transactiontrends.com/eta-expert-insights-qr-codes-in-payments/