BNPL: A Quick Overview

by 2021 ETA YPPs

YESTERDAY’S “LAYAWAY” IS THIS YEAR’S BUY NOW/PAY LATER (BNPL)?

Everything old is new again. The modern version of yesterday’s “layaway plans” is “buy now/pay later.” What’s fresh is how high tech entrants are bringing this payment choice to market and how big tech companies are partnering with retailers to make it more widely available.

BNPL purchases are poised to hit $100 billion this year. Consumers are increasingly adopting this method and businesses are maneuvering to meet demand. Partnerships between large retailers with stand alone BNPL providers (Amazon and Affirm) and acquisitions (Square acquiring Afterpay) this year shifted the payment industry landscape, and the trend is set to continue in 2022.

BNPL is a payment method that allows consumers to purchase products and services upfront and pay for them at a later time, typically over a few installments. When purchasing a product, during checkout, consumers are given the option to select “BNPL.” Generally, all that’s needed at checkout is a soft-credit check for approval and a small down payment (e.g. 25%) towards the total cost. The remaining balance is paid via installments that are commonly interest free (but not always). To note- there are a few models of BNPL that vary from this. Consumers are able to use BNPL both in store (CP) and Online (CNP). Many retailers currently accept BNPL as a payment method. Ecommerce merchants usually display the BNPL payment button alongside the usual credit card logos.

Companies such as Apple and Paypal are typically behind the scenes at participating retailers providing BNPL as an option. One thing is certain, consumers crave choice, and payment choices are no exception. As the economy continues to recover from the pandemic, BNPL payment options have gotten a boost, especially from the younger generation.

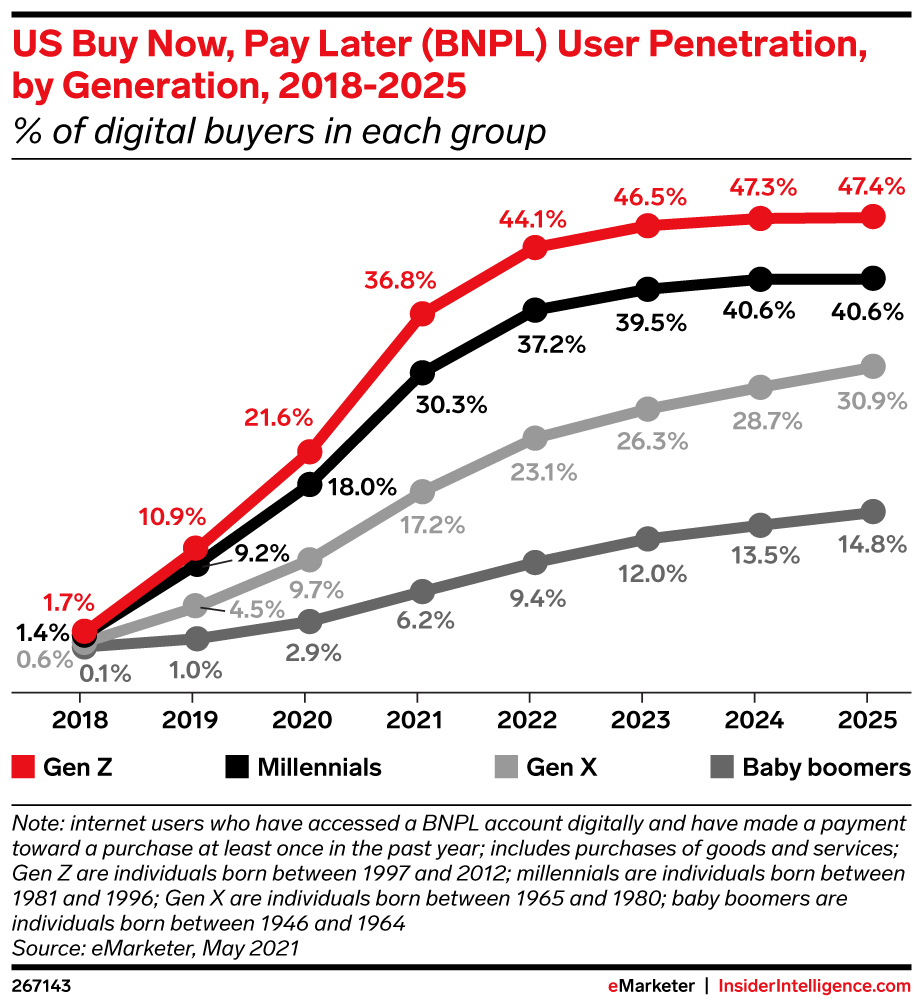

In fact, Gen Z and Millenials who have grown up with a subscription lifestyle of paying monthly for movies and music have been quicker to adopt BNPL than older consumers. Given their preference to use debit over credit, BNPL this year achieved more than 30% penetration with these two groups.

While only 6% of Baby Boomers opted for BNPL in 2021, that number is forecasted to grow to 15% in 2025, according to eMarketer 2021. During this same period, BNPL penetration is anticipated to reach 40% among Millenials. These aggressive growth projections across numerous demographics demonstrate the significance of BNPL as a payment method that’s here to stay.

Consumer choice and personalization is driving innovation in the payments industry, and it appears that BNPL has true staying power. As BNPL becomes an evermore familiar payment option at checkout alongside PayPal, today’s down payment on BNPL is certain to pay off with businesses meeting customer expectations sooner than later.

source: https://www.insiderintelligence.com/insights/buy-now-pay-later-gen-z-millennials/ and

https://www.digitaltransactions.net/?s=bnpl+phenomenon

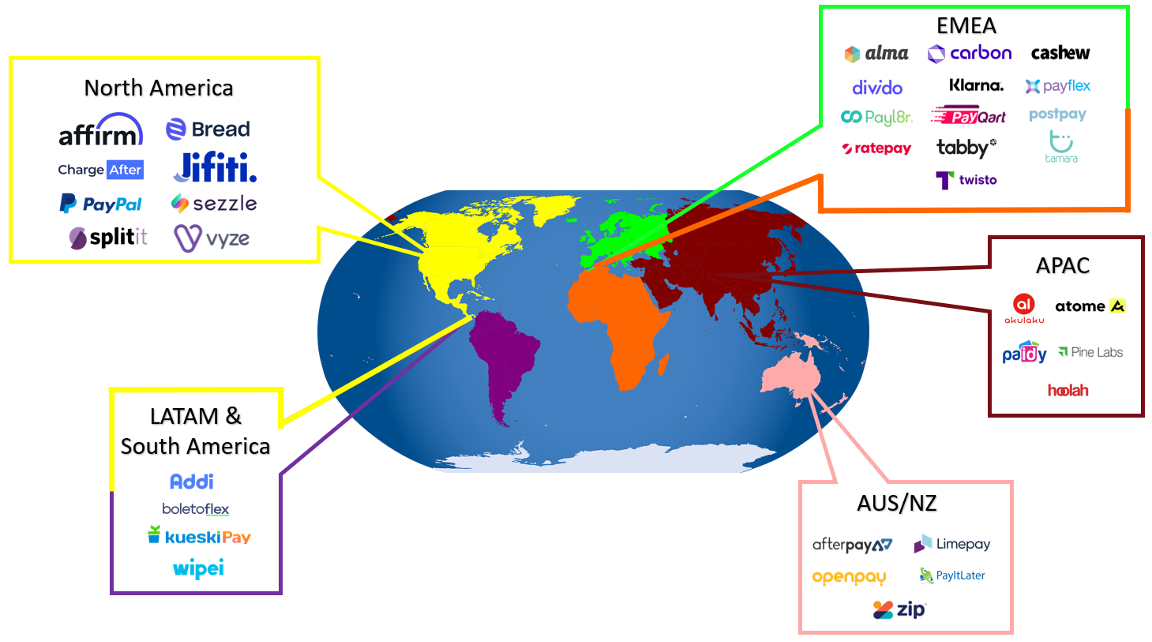

KEY PLAYERS WORLDWIDE

Here’s a look at some of the companies who have emerged as innovators in the BNPL space, each providing different features and benefits to appeal to the needs of various audiences.

The map illustrates the major players worldwide and the chart highlights key features of five companies operating and leading BNPL in the U.S.

ABOUT THE AUTHORS

The ETA YPP scholar program provides support, education and opportunity to young payments professionals, and encourages ETA YPPs to assume leadership roles within ETA and the industry.

The following 2021 ETA YPPs contributed to this article:

- Barrett Smith, JPMorgan Chase

- Shamika Williams, Talus Payments

- Christina Ding, Visa

- Victor Lolas, Paysafe

- Marc Kliesner, BillingTree

- Olivia Tomares, Square, Inc.

- Katherine Carroll, Fiserv

- Ashley Briars, Discover Financial Services

- Will Kuo, JPMorgan Chase

- Megan Karbula, REPAY