Guest Post: A Day in the Life of a PayFac According to Finix

By Angie Ammon, VP of Professional Services and Enterprise Sales, Finix and Jenny Ly, Editor In Chief, Finix

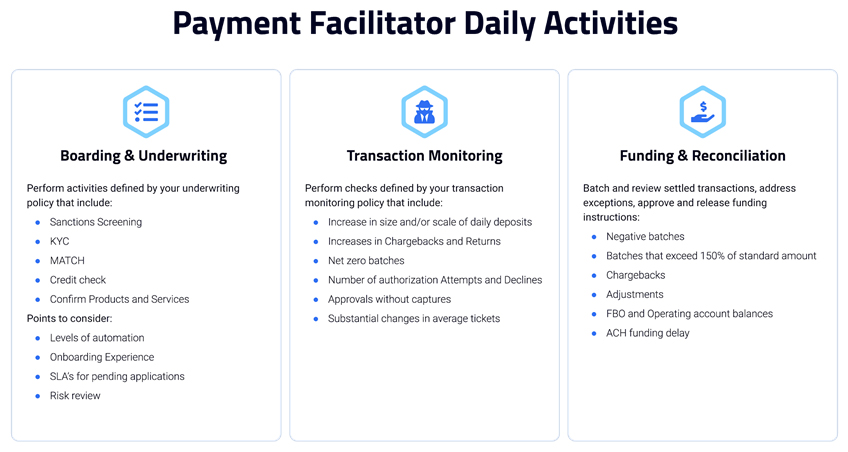

Payment facilitation is now 10 years old, and while the benefits of this model are well known (e.g. increased revenue, increased business valuation, and ownership over the customer experience), the daily operations can be confusing and unclear. In this post, we will demystify the daily operations of a payment facilitator by breaking them down into three pillars, each with distinct activities to be completed every day.

The three pillars are:

- Boarding & Underwriting

- Transaction Monitoring

- Funding & Reconciliation

To help explain the three pillars, we’ll use the analogy of hiring a new employee to join a fictional company, Greg’s Gyms. In this analogy, the new employee is a sub-merchant and Greg’s Gyms is the payfac.

Boarding & Underwriting

In the payment facilitator model, sub-merchant boarding and underwriting is managed by the payfac, unlike the traditional merchant account model. Boarding and underwriting is determining if it is a good idea to process transactions for a sub-merchant based on your risk criteria and after the completion of certain regulatory requirements such as Know Your Customer (KYC) verifications. Boarding and underwriting includes but is not limited to: (1) ensuring businesses and sub-merchants are selling the goods and services they say they are selling, (2) performing checks to guard against money laundering, terrorist funding, and other criminal activity, and (3) enabling the sub-merchant for transaction processing.

It’s important to note that the effort necessary to manage the boarding and underwriting process can vary depending on the business vertical, level of experience and effort, and technology stack.

Using our analogy, the act of completing an employee background check, verifying references, and onboarding the employee is similar to what a payfac does for each sub-merchant.

Transaction Monitoring

Once a merchant is successfully boarded they can begin processing payments. A core component of the payfac model is that the payfac is financially responsible for the activities of a sub-merchant. This includes chargebacks, data breaches, fraud, misappropriated fund distribution, etc. In order to mitigate risk, the payfac has to create processes and policies to monitor the transaction activity of its sub-merchants. This includes reviewing abnormal activity like increases in chargebacks/returns, the number of authorization attempts/declines, and questionable approvals.

Using our analogy, the act of monitoring and checking in with the new employee to make sure they are not overcharging customers or accepting fraudulent returns is similar to what a payfac does for each sub-merchant.

Funding & Reconciliation

The last and most important pillar of daily activities is funding and reconciliation. Now that your sub-merchants are successfully boarded and actively processing transactions, it is critical to have monitoring and reporting functions to efficiently review, approve, and release funds to sub-merchants. Payfacs only have a few hours each day to review their sub-merchant’s transactions, apply the necessary (if any) adjustments, and approve/release funds.

Using our analogy, Greg’s Gyms is responsible for making sure the new employee is paid accurately in a timely manner and any withholdings are taken out as needed.

Whether you’re ready to take on the responsibilities of becoming a payment facilitator today or not, get in touch with our team at Finix to learn how owning your payments stack can transform your business.

Finix builds payments infrastructure for vertically-focused software providers and fintech companies. With Finix, businesses can own and monetize their entire payments experience without having to build an in-house system from scratch or rely on third-party service providers.