ETA Expert Insights: How Consumers are Making Payments

Dan Frechtling, G2 Web Services; Member of the ETA Risk, Fraud & Security Committee

The ETA Risk, Fraud & Security Committee has created a series of short articles on how the merchant-consumer relationship in the United States has evolved and re-shaped how merchant acquirers think about risk. The first article in the series addressed how merchants accept payments. This second article will discuss the consumer perspective – the types of payments consumers prefer and how those payment preferences have evolved over time. We will then delve into eWallets – the fastest growing payment type – and the specific risks associated with them.

Overall Trends

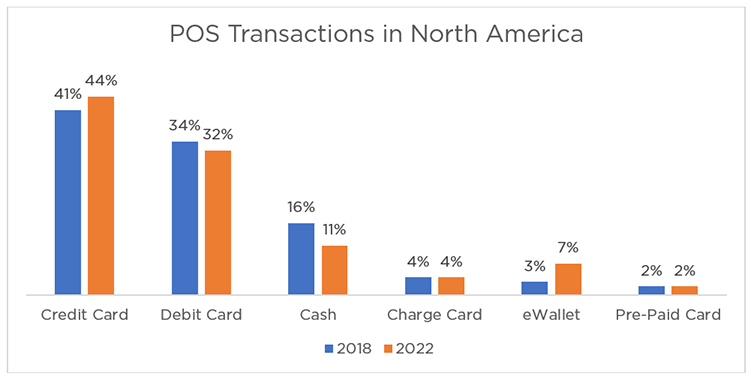

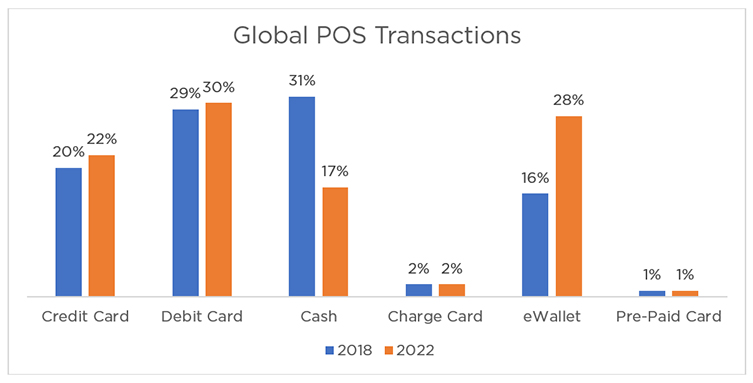

Consumers all over the world are moving away from cash and towards increasingly sophisticated forms of electronic payments. Data from the 2018 Worldpay Global Payments Report shows that in North America, credit cards account for 41% of transactions at the point of sale; debit cards account for another 34% (see Figure 1). Cash comes in third at 16% of transactions. Globally, cash is the most prevalent method for transactions at the point of sale. However, cash is projected to become less common, shrinking from 31% of global POS transactions in 2018 to just 17% in 2022. Globally, non-cash payments are expected to increase from 68% of transactions in 2018 to 83% in 2022. The increase in North America is less marked, because North American consumers have been using electronic payment methods for decades – nonetheless, non-cash payments in North America are projected to increase from 84% of transactions in 2018 to 89% in 2022, while cash slips from 16% to 11% over the same time period.

Figure 1

Source: 2018 WorldPay Global Payments Report

Ascendency of eWallets

Out of the diverse array of electronic payment options for consumers today, eWallets are the fastest growing segment. An eWallet, sometimes called a digital wallet, securely stores users’ payment information and passwords for numerous payment methods and websites. It is most commonly associated with mobile phones, which can be used for physical commerce and e-commerce, but can also be used on a computer for eCommerce. eWallets allow consumers to:

- Complete purchases easily and quickly

- Authenticate biometrically or with conveniently stored passwords (avoiding worry about remembering them)

- Link their driver’s license, health card, loyalty card(s) and other ID documents stored on the phone (an eWallet can easily verify the age of the buyer)

- Integrate them with the financial institutions and favorite merchants thanks to open banking and APIs and open banking

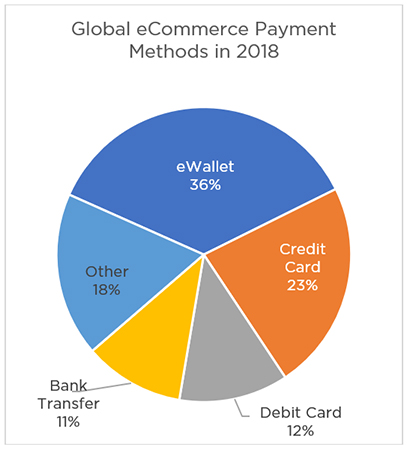

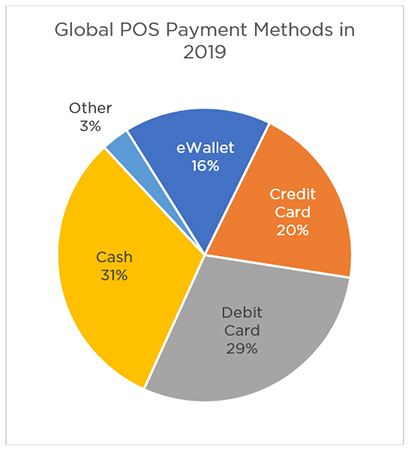

All of these factors contribute to the increasing consumer adoption of eWallets. Another major factor is the growth of eCommerce, which favors eWallets. See Figure 2, which also come from the Worldpay report. eWallets make up 36% of eCommerce transactions globally but only 16% of transactions at a physical points of sale (POS).

Figure 2

Source: 2018 WorldPay Global Payments Report

Large, global technology companies – Apple, Amazon, Alibaba, Facebook, and Google – are driving the move toward eWallets. These Big Tech companies account for over 70% of the global e-wallet market, according to the Cap Gemini Global Payments Report. They can leverage their large-platform user base to gain traction in the payments space, focusing on providing seamless user experience and value-added features, and taking advantage of network effects. Many Big Tech eWallets offer personalization, rewards, and the ease of peer-to-peer payments. A number of countries outside the US, such as China, Russia and India, have home-grown champions.

Risks of eWallets

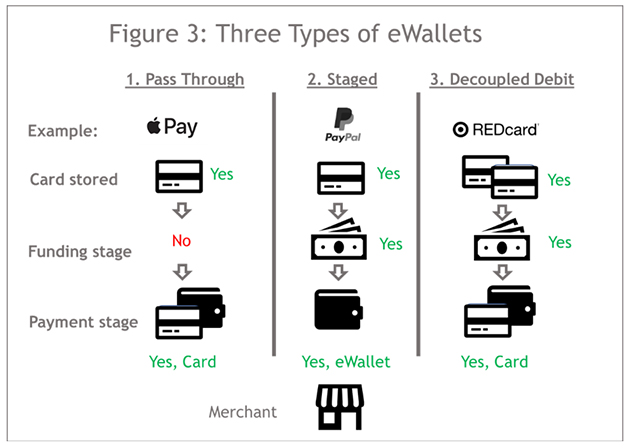

In the world of risk, there are three types of wallets: Pass through, Staged, and Decoupled debit (see Figure 3). Pass through eWallets are simply containers for other payment types (a credit card, for instance – or, in the case of many mobile wallets, a tokenized representation of the user’s credit card credentials). They do not carry funds on their own. Most mobile wallets are pass through. In other words, they support cards rather than compete with them. In contrast, Staged wallets introduce a funding stage whereby the account is topped off by another payment method. Staged wallets replace the customer’s payment information with credentials provided by the eWallet operator. Examples include Paypal and Alipay.

Decoupled Debit cards are a bit different. Traditionally, a debit card is issued by a bank and linked to the customer’s checking or savings account at that bank. A decoupled debit card is not linked specifically to any financial institution, but can be issued by others. Retailers are common issuers – Target’s REDcard, used only for purchases of Target merchandise, is a great example. When payments are made, the transaction goes from the merchant to the processing network, such as MasterCard or Visa. The issuer of the decoupled debit card authorizes the transaction and uses an ACH for the transaction so that the merchant receives the payment.

Figure 3

Acquirers face important responsibilities with regard to eWallets. These include the obligation to:

- Ensure the Digital Wallet Operator is registered with the card networks

- Ensure the Staged Digital Wallet Operator obtains cardholder consent at the time of loading to use stored cardholder information to initiate transactions

- Transmit the three-digit Wallet Identification Number (WID)

- Ensure that adequate Know-Your-Customer (KYC) procedures are performed

The KYC responsibilities can be demanding. Acquirers must first Know-Your-Wallet. This begins at onboarding and is ongoing. The acquirer should request eWallet customer lists, looking for high risk merchants and secondary wallets that require additional due diligence, high risk registration, and sometimes termination of relationships. Just like merchants, marketplaces, and Payment Facilitators, Staged Digital Wallet Operators must be within the acquirer’s approved jurisdiction. Finally, acquirers may be required to meet a minimum equity requirement, which can be waived by the card network if adequate risk controls exist.

eWallets are characterized by big growth, Big Tech, and big compliance responsibilities. But while many observers characterize them as a threat to existing payment networks, many eWallets use the existing payment network rails to some extent. Credit, debit, and charge cards are frequently used to “load” eWallets, or may directly accept the transaction for “pass-through” digital wallets that don’t require loading. eWallets add a new layer of security and convenience to the existing payments infrastructure – particularly in eCommerce – and are part of a broader payments ecosystem anchored by the card networks and incumbent financial institutions.