Online Small Business Lending Provides Benefits to Small Business Owners

No matter which way you cut it, American small business statistics are impressive.

According to the Small Business Administration, American small businesses create two out of every three net new private-sector jobs. 99.7 percent of all private sector firms with paid employees are small and medium businesses. From your neighborhood coffee shop, to that favorite new restaurant in the hip part of town, to the fast-growing tech startup down the street, America’s small and medium businesses contribute to the American economy in many important ways. And ETA members are often at the forefront of providing small and medium business owners with innovative payments and FinTech solutions for their businesses.

It’s no secret that small business owners need quick and streamlined access to credit to grow their businesses and the American economy. One option for American entrepreneurs are online small business lenders. Online small business lenders are financial firms that provide credit to small business owners through automated, technology-enabled platforms. They regularly work with traditional lenders to deliver loans. By leveraging the ubiquity, speed and convenience of the Internet, online small business lenders use sophisticated software platforms to provide American small business owners with fast, easy and affordable credit.

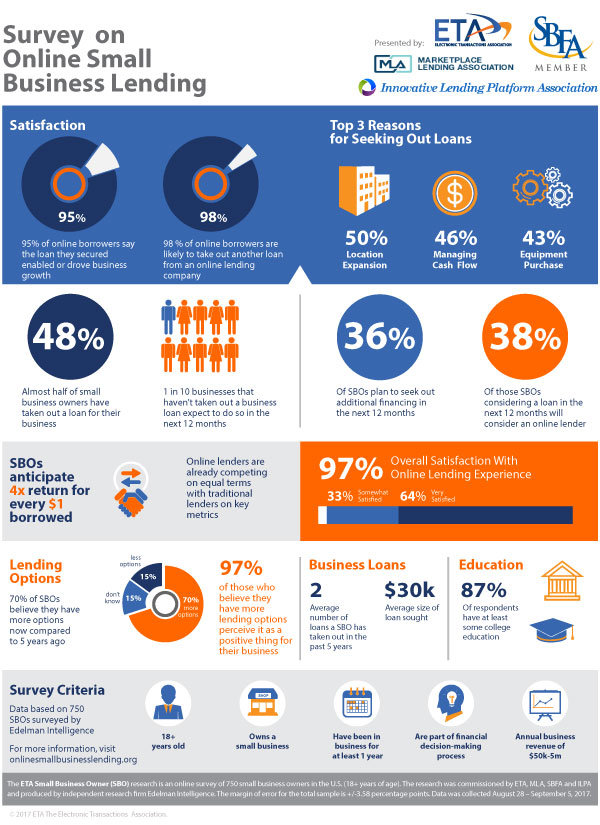

ETA – as part of a joint coalition with four other trade associations — recently commissioned a survey of small business owners and found that that a large majority (70%) of small business owners believe there are more credit options today when compared to five years ago, and 97% of those feel that the growing number of financing options is a good thing.

Key findings of the study include:

- An overwhelming majority of small business owners reported more lending options available now than five years ago. 70 percent of small- and medium-sized business owners say there are more lending options now, and 97 percent of those believe that the increase in options is a positive thing for their businesses.

- Most small business owners reported using online small business lenders to help them expand their locations, make necessary hiring and equipment purchases, and help manage cash flow.

- Of the small business owners considering taking out a loan in the next 12 months, close to 40 percent say they will consider borrowing from an online lender.

- Online small business lenders have high levels of satisfaction and scored high marks for ease of use and business growth enablement. According to the study, 98 percent of small business owners who have used online lenders say they are likely to take out another loan with an online lender.

- For many small business owners, online small business lending platforms are a popular alternative to asking friends and family for a loan.

For more information, see the full coalition press release here and visit onlinesmallbusinesslending.org.